This innovative financing tool could reduce violence in a city near you

Could social impact bonds reduce urban violence? Image: REUTERS/Jim Young

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

Cities and Urbanization

Each year roughly half a million people are murdered in and outside war zones around the world. Tens of millions more are psychologically and physically injured as a result of crime. Another 9 million people are locked up in prison. The pain and suffering resulting from such violence are incalculable.

Yet it is possible to tabulate the global economic cost and lost productivity associated with victimization and incarceration. The latest estimates suggest that the economic burden associated with homicide alone reached $1.7 trillion in 2015. If all forms of violence are included, the price tag rises above $13 trillion.

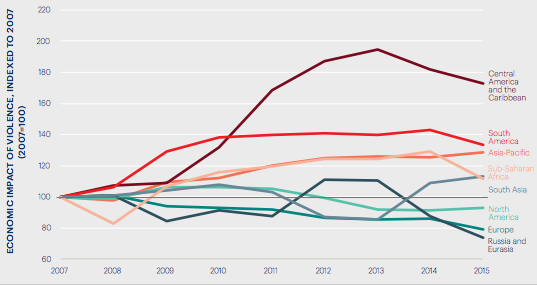

Economic costs of violence – regional trends (2007-2015)

The economic impacts of violence as a percentage of GDP and the 2015 Global Peace Index score

The good news is that sharp reductions in lethal violence and repeat offending are entirely realistic. Notwithstanding modest increase in murder over the past two years, most US cities witnessed a dramatic decline – as much as 40% – in homicidal violence over the past two decades. Some of Latin America’s most homicidal cities also experienced dramatic reductions in lethal violence.

Despite newly minted global commitments to prevent and reduce violence, there is still a remarkable gap between good intentions and financial commitments. Governments, many of them mired in debt, are unable to muster adequate resources. Making matters worse, private businesses are reluctant to donate to sensitive issues, and not-for-profit groups are rarely able to scale-up their work or lock in sustainable investment.

Consider the case of Chicago. Violence costs the city roughly $2 billion a year. Meanwhile, the state’s deficit has ballooned to $8 billion which means it’s had to dramatically cut back on expenditures. Even effective violence prevention organizations such as CureViolence have been badly hit. And this in spite of the fact that every $1 spent there yielded an estimated $18 in violence cost savings, including $2 in government expenditures.

There will always be requests for more public spending in Chicago, and any other city for that matter. Owing to the exceedingly high costs of violence, perhaps it’s time to ask for less and instead help public authorities reduce their costs. One way to cut government costs is through “pay-for-success agreements”, including social impact bonds. The idea is elegantly simple.

A social impact bond is essentially a contract with the public sector to pay for improved social outcomes at a potentially reduced cost. The private sector – and not the taxpayer – puts up the capital and service providers are paid with invested funds. Such bonds don’t necessarily offer a fixed rate of return. Instead, repayment is contingent on achieving mutually agreed results. If the specific targets are met, providers are paid and investors rewarded with profits. If they are not, the government is not required to pay for said services.

There is growing enthusiasm for social impact bonds. There are already 60 social impact bonds underway in 15 countries, raising more than $216 million in investment. The majority are focused on under-serviced sectors such as child and maternal health, early childhood development and youth employment. At least 20 of them – some $50 million worth – are targeting criminal justice reform, domestic violence prevention and preventing recidivism.

Several social impact bonds designed to improve public security have been launched over the past decade. In the UK, the most well-known initiative kicked-off in 2010 and sought to reduce recidivism in prisons. Meanwhile, in the US, the Departments of Justice and Labor have committed over $20 million to social impact bonds since 2012. Most of these are designed to reduce recidivism and promote skills-training. In both cases, governments, service providers, banks, venture capital firms and philanthropic groups worked together.

Between 2010 and 2015, the world’s first social impact bond was launched to support a programme to reduce recidivism in Peterborough prison in the UK. A collection of service providers offered 12 months of support to roughly 2,000 adult males to reduce the prevalence of re-offending. The outcomes were surprisingly positive.

Within four years, independent evaluations revealed a drop in recidivism of 8.4%, below the 10% target, but above the 7.5% pay-out floor required of the Ministry of Justice. Despite not reaching all its targets, the initiative was hailed a success. The impact bond was supported by the Big Lottery Fund and 17 charitable foundations. It was halted in 2015, however, due to the start of a new national programme with different targets.

In the meantime, several new social impact bonds have been launched in the UK. For example, in 2015, the Big Lottery Fund supported the world’s first social impact bond targeting gang violence reduction. Working in partnership with Catch22, a local NGO, the initiative set clear targets to reduce involvement in gangs, knife crime and police investigations/convictions of around 1,000 high-risk young men.

Likewise, in 2015 the London Mayor’s Office started exploring a social impact bond to support the Pan-London Gang Exit and Resettlement Programme. The goal is to provide exit and training opportunities for gang members. The social impact bond is being delivered across all London boroughs. It is still too early to determine their success.

The US experience with social impact bonds is also growing rapidly. For example, in 2015 the Massachusetts government partnered with Goldman Sachs, Third Sector Capital, the Boston Foundation, and other partners to launch the Pay for Success initiative. The service provider, Roca, is expected to reduce recidivism by 10% and improve employment outcomes over a seven-year period in three cities: Boston, Chelsea and Springfield. The initial cohort includes 929 at-risk young males focusing on behavioural change, job readiness, educational readiness and life skills. The government stands to make $27 million in success payments if targets are met, the largest such investment to date.

It is worth underlining that Massachusetts will only make pay-outs if Roca’s programs generate positive outcomes. Success payments will be issued in the second and seventh years based on hard metrics agreed up-front: decreased incarceration, increased job readiness and rising employment.

Overall, the project is expected to make budgetary savings to the Massachusetts government equal to cost of delivering services. The pay-outs are to be provided by the US Department of Labor (which awarded a grant of $11.7 million). If the project delivers initial results, the Department of Labor will extend the project to 1,320 offenders over nine years.

Work is now beginning by some intermediaries and service providers to launch similar social impact bonds in major US cities, beginning with Chicago. Social impact bonds are also being rolled out in developing countries, including Brazil, Cameroon, Chile, Colombia, Costa Rica, Mexico, Mozambique, the Occupied Palestinian Territories and South Africa.

For its part, the Inter-American Development Bank has also started laying the ground for social impact bonds in Latin America, focusing on citizen security and violence prevention. Several service providers and intermediaries recently started work on developing social impact bonds to reduce homicide in a handful of Latin American cities.

While early days, there is evidence that social impact bonds can have positive results. At a minimum, they offer an exciting new means to channel private capital into resource-deprived sectors to strengthen social service infrastructure. There are studies showing they generate positive impacts while reducing the burden of spending on the state. The intention is never to replace the public sector, but rather to make better use of private funds for the public good.

Even so, it’s clear that not all sectors are suitable for social impact investing. What is more, investors must be confident in the institutional capability, data availability and contract validity before they engage. And while social impact bonds might offer a novel approach to financing violence reduction, they do have their critics.

For one, they are not problem free and are tricky to implement (and enforce if targets are not met, since the contracts tend to be very complicated). Some governments encounter challenges entering into and enforcing such contracts since they cannot take on liabilities in their operating budgets without having matching funds/collateral.

There are also concerns that social impact bonds are restricted to small-scale interventions and have yet to deliver major savings to governments and profits to investors. For that reason, some investors are still wary of investing in bond-supported interventions without an iron-clad track-record on the part of service providers.

Important questions do remain about the scaleability of social impact bonds, but it is likely that we are just a few years into a multi-decade market maturation process. There are also signs that some major players are entering into the space. Goldman Sachs Asset Management recently acquired Imprint Capital, an impact investing advisory firm. Leapfrong Investments has over $1 billion in equity commitments to impact investment (albeit mostly focused on healthcare and financial services in Africa/Asia). And the Wharton School recently released a report suggesting over three private equity impact funds could achieve targeted returns and mission-aligned exits.

The freshly minted Sustainable Development Goals (SDGs) call for the elimination of all forms of violence by 2030. They also call for dozens of other targets, all of which will require financing. But the SDGs will cost trillions – a challenging task given current global financial tumult and uncertainty. Government budgets are already constrained by debt and deficit.

The only way to bridge the violence prevention and reduction funding gap is to come up with innovative solutions. Governments cannot be relied on to cover all costs. A new movement is emerging that isn’t just talking about the extraordinary costs of violence to taxpayers, but is also fielding the financial tools to do something about it.

This article was co-authored by Alistair Gee, chief operating officer of the Institute for Economics and Peace.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Cities and UrbanizationSee all

Victoria Masterson

April 17, 2024

Victoria Masterson

April 12, 2024

Victoria Masterson

April 11, 2024

Sam Markey and Andrew Watkins

April 5, 2024

H. Kit Miyamoto, Olivia Nielsen, Ommid Saberi and Guido Licciardi

March 27, 2024

Victoria Masterson

March 26, 2024